Two basic categories exist for credit facilities: long-term and short-term. The former is utilized for the organization’s working capital needs, including debt repayment. To cover the enterprise’s capital expenditure needs, bills are employed, while bonds are raised through a combination of private placements for bank loans.

- Loans for an short period

- Loans for an extended period

The financing of international trade:

It is necessary to have this form of credit facilities to have a smooth cash conversion cycle and can be any of the following organizations.

Credit Letters:

Typically, the bank that issues the supplier’s loan will conduct its due diligence and request collateral from the company before issuing the loan. This arrangement would be preferred by the provider because it reduces the credit risk for the consumer. A bank guarantees the payment from the corporation to the supplier in this more safe kind and credit. Which may be situated in an area that is prone to natural disasters.

Loans for a short period:

A more capable borrower may be able to acquire a loan with no assurance. Borrower’s and receivables are inventory. Revolving credit arrangements are also used by several significant corporations. The conditions under which the business was obtained a loan.

Short-term loans can be taken out by corporations as well as for the company. The working capital requirements, which could be short as one year. Continually repay borrowed within a defined amount of time. Depending on the borrower’s credit rating, this loan facility may or may not be secured.

Compared to regular loans, these have a higher interest rate and can last up to five years. However, there is a commitment charge and a slightly higher rate of interest. A non-investment grade borrower, on the other hand, may be required to provide current assets as collateral for the loans.

Suppliers deserve credit for the work they’ve done. The supplier’s payment terms must be negotiated to ensure a successful transaction. Customers with whom a supplier has a good working relationship are most likely to extend the credit to them. Loaning from the borrowing base is a short-term lending facility for commodities trading enterprises for secured.

Credit for exports:

Government agencies give exporters this type of financing to encourage the growth of their external trade.

Factoring:

This agreement may assist the company in removing receivables from its books and meeting its short-term liquidity requirements. When a corporation sells the accounts receivable, it uses factoring as a sophisticated borrowing known as a loan.

The next step is to examine the typical structure of long-term credit facilities. Banks, private placement, or other institutions can provide them with credit as well as the financial markets.

Overdraft protection and cash credit facilities:

The borrower would then be liable for paying interest on the overdraft at the rate in effect only at the time of the insufficient money. Amount and interest rate of the overdraft loan are usually determined by the credit score of the borrower. A corporation can take out more money from a line of credit than it has deposited.

A loan from a bank:

Secured and unsecured loans are both available, with rates of fluctuation.

Long-term loans are the most cost-effective when done with more excellent care. Covenants may be included as part of the due diligence process.

To handle the credit risk of the bank is requested to assume because of the long-term tenor, a bank performs substantial due diligence before lending. Most of the long-term credit facilities are in a term loan, which has three main characteristics: a fixed sum, a set term, and a predetermined repayment plan.

Amounts owed on mezzanine financing:

Finance on the mezzanine level:

When it comes to payment defaults, debt is a hybrid of an equity. In light of the increased risk, they require only private equity or hedge fund return rates.

This type of company was invested in more risky assets. Mezzanine debt is often employed by a private equity investor in a leveraged buyout situation. This debt is secured only by the company’s common stock and subordinate to all others. A short-term loan is used to bridge the gap between two installment payments on a loan

A bridge loan is a short-term loan taken out by a corporation. while it is waits for long-term finance to come through. When the markets become more favorable for raising funds, the Bridge loan can be repaid through bank credits, notes, or even equity financing. A bridge facility is a another type of credit arrangement. And it is typically used for working capital.

Observations of Credit Facilities:

Financing for these credits are obtained through private placements or capital markets, and the loans are often unsecured. As a result, the company only considers them if the banks are unwilling to make any more loans.

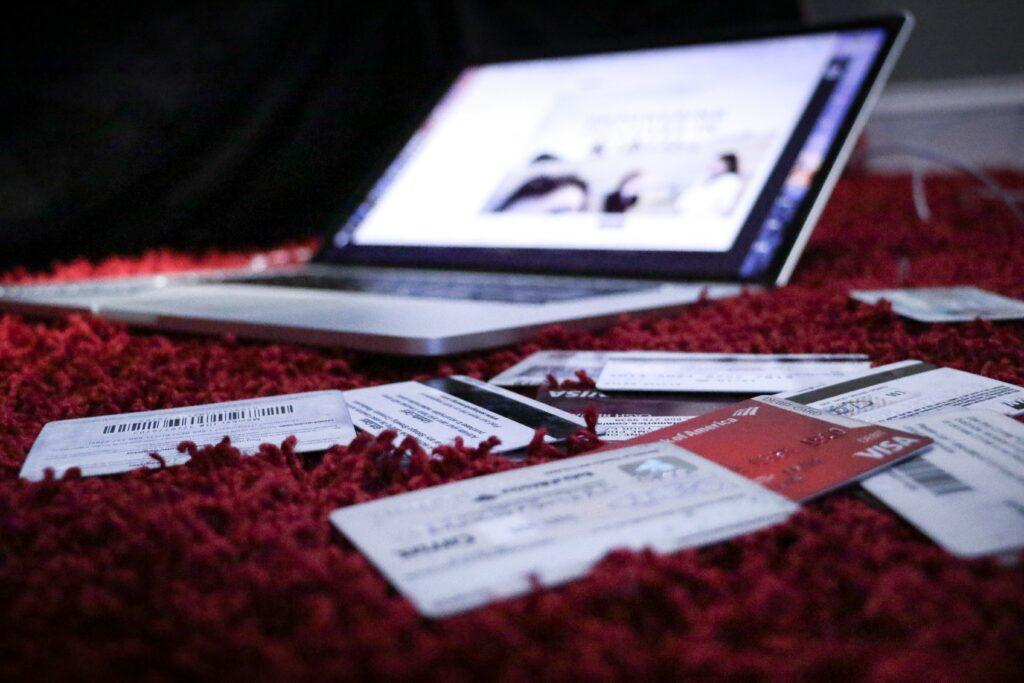

Lenders are ready to take on a higher credit risk because it means a higher cost for the enterprise. There is a ensuring against fraud and identity theft. Factoring of receivables is a form of credit facility quite similar to this one previously discussed.

Aside from asset liquidity and institutions involved, there isn’t much of a difference. There could be several parties engaged, as well as long-term receivables.

Credit card receivables, mortgage receivables, and non-performing assets of a financial organization are examples of securitized assets. Raising capital through the sale of stock is still an option for a firm.

Raising debt may be preferred by business owners since it helps them maintain control over their company. The ability to service interest and principal payments are, of course, a significant consideration in making this selection.

As a result, the terms of payment, interest rates, and collateral are all different. The entire loan negotiating process is crucial in developing a company’s financial strategy. A company’s long-term growth prospects to help a business run smoothly. Several financial facilities are available to help these various parts together. A financial institution might act as a “factor” in factoring and buying a company’s trade receivables on the company’s behalf. Finally, the debt structure, equity capital, credit facilities and business risk must all be considered in the same way. The operations of a heavily-levered corporation, as well as the stock price, may be adversely affected.